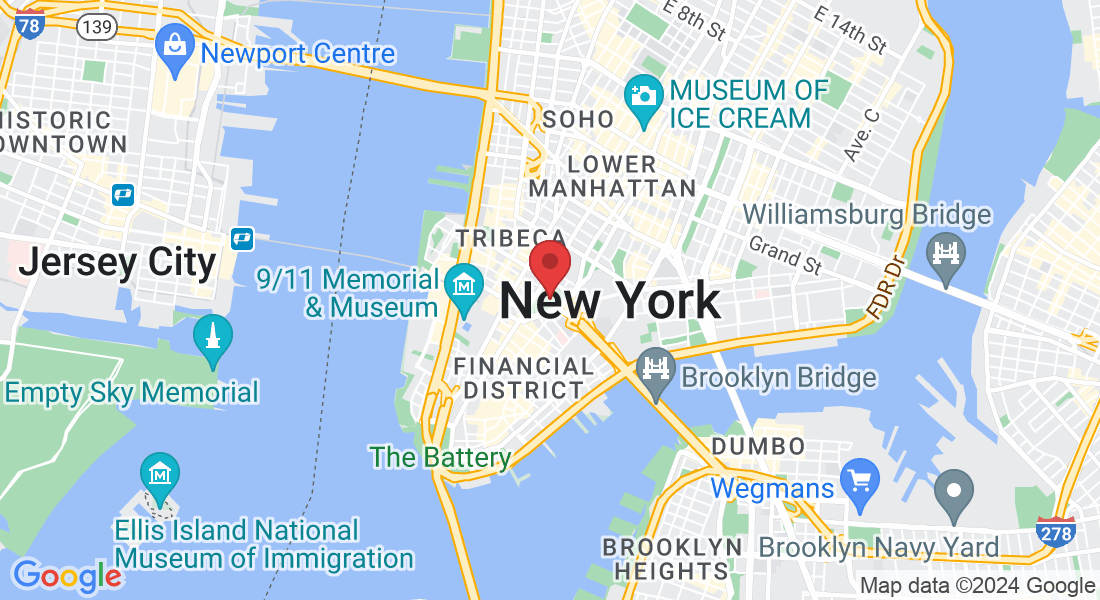

Unlock the path to freedom by investing in vacation rentals.

Every individual deserves the opportunity to attain the five freedoms: Financial, Time, Location, Relational & Impact.

Schedule a FREE consult & let me show you how!

The opposite of Courage is not Cowardice, its Conformity. Be Different!

The Strangest Secret

Earl Nightingale

About us

We've been helping high income professionals build generational wealth by investing in Vacation Rentals for many years

Maximize your wealth with vacation rental investments. Benefit from consistent cash flow, value enhancement, asset appreciation, and significant tax savings.

We’ve worked with investors to acquire and operate millions of dollars worth of Vacation Rentals and create generational wealth.

Embark on a journey to generational wealth and a life brimming with adventure and cherished moments with family and friends. Your search ends here!

The 5 Freedoms

Every person is in pursuit of the five freedoms. Isn't that true for you too?

Time Freedom

Ability to control and manage one's own schedule independently.

Financial Freedom

Sufficient wealth to live life on one's own terms

Location Freedom

Freedom to choose and change living and working locations freely.

Relational Freedom

Forming and maintaining personal and professional relationships.

Impact Freedom

Liberty to affect change and influence positively in desired areas.

Want to build a legacy of generational wealth while still having the best time of your life?

Achieving & Retaining your Freedoms is the goal and investing in Vacation Rentals is a means to an end! Its all about priorities!

Client Testimonials

I chose Karan for his vacation rental expertise and was impressed by his success. He provided invaluable knowledge, guidance, and feedback, connecting me with key contacts for lending and property search.

His insights on Vacation Rental investing tax strategies and guest experience were crucial. Many colleagues have also found success with his mentorship. I highly recommend Karan.

Omkar Hirekhan • Ohio

Karan was key to my entry into the vacation rental market. His support and insights made the daunting numbers and systems manageable, leading to a smooth launch. His expertise in setting up and listing properties, along with his experience in purchasing, is invaluable.

He adeptly navigates challenges and avoids pitfalls. For anyone looking to enhance their wealth through real estate, Karan is the go-to coach.

Gretchen Bruno • Colorado

I appreciate Karan's expert coaching in the vacation rental field, significantly enhancing my business. His strategic market insights and customized advice have increased my property's profitability.

Karan's guidance in pricing, marketing, and efficiency has been pivotal. I strongly recommend him for remarkable results in the vacation rental market.

Marco Molina • Connecticut

Our Programs

We offer specialized programs for success in vacation rental investment , tailored for both beginners and seasoned hosts. Our programs cover everything from the basics of evaluating and acquiring them to advanced strategies for growth and sustainability.

Explore our programs and find the one that matches your goals. Let us guide you to vacation rental success with our expert coaching and personalized support. Start your journey today.

Individualized Coaching

Personalized guidance focusing on the individual's specific goals, challenges, and progress. Offers deep, tailored development and accountability.

Mastermind Group

Peer-to-peer mentoring groups where members learn from each other’s experiences under the facilitation of a leader, focusing on mutual growth and accountability.

Group Coaching

Small groups work together under a coach's guidance, fostering peer learning and support alongside personalized attention.

Self-paced Online Course

Learners complete courses at their own pace, accessing pre-recorded lectures and materials online. Ideal for those with irregular schedules or who prefer solitary study.

In-Person Workshops

Hands-on training sessions conducted at specific locations, providing direct interaction and immediate feedback.

Webinars

Short, focused sessions on specific topics, delivered either online (webinars). Useful for concise overviews or deep dives into niche subjects.

Free Resources

READ THE GUIDE

10 Considerations when investing in Vacation Rentals

Investing in short-term rentals can be a lucrative endeavor, but it requires careful consideration and planning. Looking to invest in one? Check out our Guide

READ THE GUIDE

10 Foundational Elements to evaluate if you are ready to invest in Vacation Rentals

Being successful with investing in Short Term Rentals involves evaluating your financial situation, understanding the market, and being prepared for the responsibilities that come with being a host. Here are the foundational elements to ensure success!

Podcast

Subscribe to our podcast and unlock a wealth of free learning!

We're committed to providing maximum value through each episode, offering insights, stories, and knowledge to enrich your life. Join our community of eager learners and start gaining more without spending a thing. Your journey to maximum value starts here!

Interested in being a Podcast guest? Use the button below to submit your information for consideration

Request a free coaching session.

Take the first step today.

Unsure where to begin? Arrange a call with us to identify the most effective strategy for your success journey.

Take the first step in faith. You don't have to see the whole staircase, just take the first step.

- Martin Luther King Jr.

OUR TEAM

Meet Our Awesome Team

John Doe

John Doe

John Doe

John Doe

Frequently Ask Question

Is investing in Vacation Rentals risky?

Investing in vacation rentals, like any real estate investment, carries its own set of risks and rewards. The key factors that influence risk include market volatility, regulatory changes, operational challenges, and fluctuating demand. However, with the right approach, these risks can be managed and mitigated. Thorough research, strategic planning, and understanding your market can significantly reduce uncertainties.

Additionally, diversifying your investment portfolio and employing professional management services can also help manage risks effectively. It's important to remember that while there is inherent risk, vacation rental investing offers the potential for substantial returns, especially in high-demand locations.

By making informed decisions and staying adaptable to market trends, you can turn these risks into opportunities for growth and success. Investing wisely in vacation rentals can indeed be a lucrative and rewarding venture.

How much capital do I need to start?

The amount of capital needed to start investing in short-term or vacation rentals varies widely depending on several factors, including the location of the property, its size and condition, the current real estate market, and your investment strategy. Here's a breakdown to give you an idea:

Property Purchase: The most significant initial expense is the cost of acquiring the property. Prices can range dramatically from tens of thousands in less expensive regions to millions in high-demand areas.

Down Payment: If you're financing the purchase, expect to put down anywhere from 10% to 30% of the property's price, depending on the lender's requirements and whether it's considered an investment property.

Renovation and Repairs: Depending on the condition of the property, you may need to invest in renovations and repairs before listing it. This cost can vary greatly.

Furnishings and Supplies: To make your property rental-ready, you'll need to furnish it and stock it with necessary supplies. This can cost anywhere from a few thousand dollars to much higher, depending on the size of the property and the level of luxury.

Operating Expenses: Initial operating expenses might include property insurance, utility setup fees, property management fees (if you're not self-managing), and marketing costs for your rental listing.

Reserve Funds: It's also wise to have a reserve fund for unexpected expenses, vacancies, or emergencies.

As a rough estimate, starting a short-term rental business could require anywhere from $20,000 to $100,000 or more in initial capital, not including the purchase price of the property. These figures can vary widely based on your specific circumstances and the market you're entering. It's important to conduct detailed research and financial planning to understand the capital requirements for your particular situation.

Is financing available for vacation rental investing?

The amount of capital needed to start can vary widely based on location, property type, and other factors. Financing options are available, and lenders do offer loans for vacation rentals. A coach can guide you in choosing the appropriate financing to suit your needs.

Are there any Tax benefits to investing in Vacation Rentals?

Yes, investing in vacation rentals can offer several tax benefits. These may include deductions for property expenses such as mortgage interest, property taxes, operating expenses, maintenance, repairs, and depreciation. Additionally, if you actively participate in managing your rental, you might qualify for further deductions. Always consult with a tax professional to understand the specific benefits applicable to your situation and how to maximize them.

Do I need a Coach?

Choosing to invest in a coaching program for short-term rentals can significantly enhance your chances of success in this competitive market. A coach brings invaluable expertise, tailored strategies, and industry insights that can fast-track your learning curve, helping you avoid costly mistakes and capitalize on opportunities more efficiently. With personalized guidance and support, you'll gain the confidence and skills needed to make informed decisions, optimize your investment, and achieve your financial goals faster.

Investing in a coaching program isn't just about learning the ropes; it's about empowering yourself with the knowledge and tools to build a profitable short-term rental business. Remember, the right coaching can be the difference between a struggling investment and a thriving one. Start your journey on a solid foundation and give yourself the competitive edge you need to succeed.

Call 682-651-1700

Email: info@vacationrentalmastery.com

Site: www.vacationrentalmastery.com